Online Travel Agencies (OTAs) face fierce competition in today’s digital travel landscape. Travelers expect a seamless booking experience, and a clunky checkout process can be a dealbreaker. This is where selecting suitable payment gateways becomes crucial.

In this blog, we’ll explore the most preferred payment gateway options for OTAs and the factors to consider when making your choice. We’ll equip you with the knowledge to ensure a smooth customer checkout journey, boost conversions, and build traveler loyalty.

When it comes to payment gateways for OTAs, several options stand out:

Selecting the right payment gateway requires careful consideration of several factors:

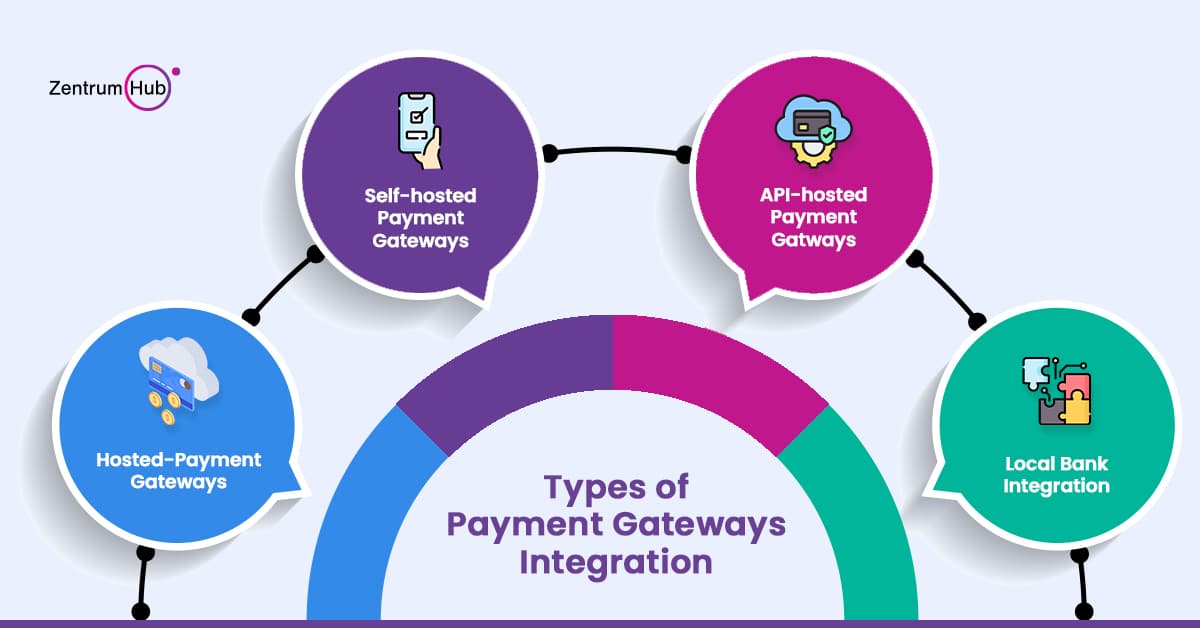

Now that we’ve explored popular payment gateway options let’s delve into the different integration methods:

Payment Card Industry Data Security Standard (PCI DSS): This security standard is a global mandate for any organization that stores, transmits, or processes cardholder data. When selecting a payment gateway, ensure they are PCI DSS compliant. This provides peace of mind that your customer’s financial information is protected according to industry best practices.

Merchant of Record (MOR): For OTAs that outsource payment processing entirely, partnering with a Merchant of Record can be a strategic decision. A MoR assumes full responsibility for PCI DSS compliance and financial transactions, allowing OTAs to focus on selling travel products and services. However, this also means relinquishing some control over the customer payment experience and potentially incurring additional fees associated with the MOR service.

The decision of whether to become your Merchant of Record or outsource to a third-party provider depends on several factors:

In conclusion, selecting the right payment gateway and deciding on the Merchant of Record approach are crucial for OTAs. By carefully considering the above factors, OTAs can ensure a secure and streamlined checkout experience for their customers, fostering trust and driving business growth.