Meet us at

New Delhi

25-27 Feb 2026

ITB Berlin

3–5 Mar 2026

DWTC, Dubai

4 – 7 May 2026

New Delhi

25-27 Feb 2026

ITB Berlin

3–5 Mar 2026

DWTC, Dubai

4 – 7 May 2026

In today’s interconnected world, the hotel industry faces significant challenges in safeguarding against payment fraud, a pervasive threat that can result in financial loss and reputational damage.

Understanding how fraud occurs and implementing effective preventive measures is crucial for maintaining trust and security in transactions.

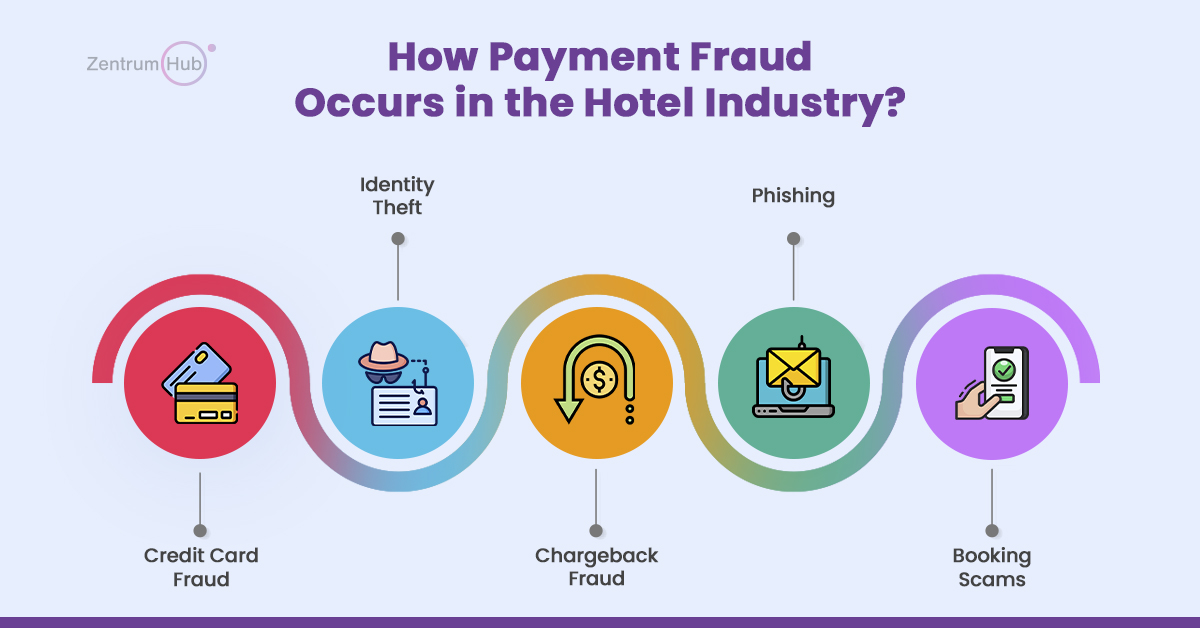

Payment fraud in the hotel industry can take various forms, each exploiting vulnerabilities in payment processes and guest information handling:

These tactics highlight the diverse methods used by fraudsters to exploit vulnerabilities in payment processes within the hospitality sector.

Read more The Role of AI in the Hospitality Industry: 2024 Trends

To combat payment fraud effectively, hotels can implement several preventive measures:

Stripe Radar is a robust fraud detection solution that leverages advanced technologies to safeguard against fraudulent activities. Key features include:

At ZentrumHub, integrating Stripe for payment processing and fraud protection has been instrumental in safeguarding clients from fraudulent activities. By leveraging Stripe Radar’s advanced capabilities, ZentrumHub ensures:

In conclusion, the implementation of advanced fraud detection solutions like Stripe Radar is crucial for the hotel industry to mitigate risks associated with payment fraud. By combining technology-driven approaches with proactive measures, hotels can enhance security, protect financial assets, and uphold customer trust in an increasingly digital landscape.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Manage your cookie preferences below:

Essential cookies enable basic functions and are necessary for the proper function of the website.