- Products

Products by ZentrumHub

-

Zentrum Booking Engine

Zentrum Booking Engine

-

Zentrum Connect

Zentrum Connect

Zentrum Booking Engine

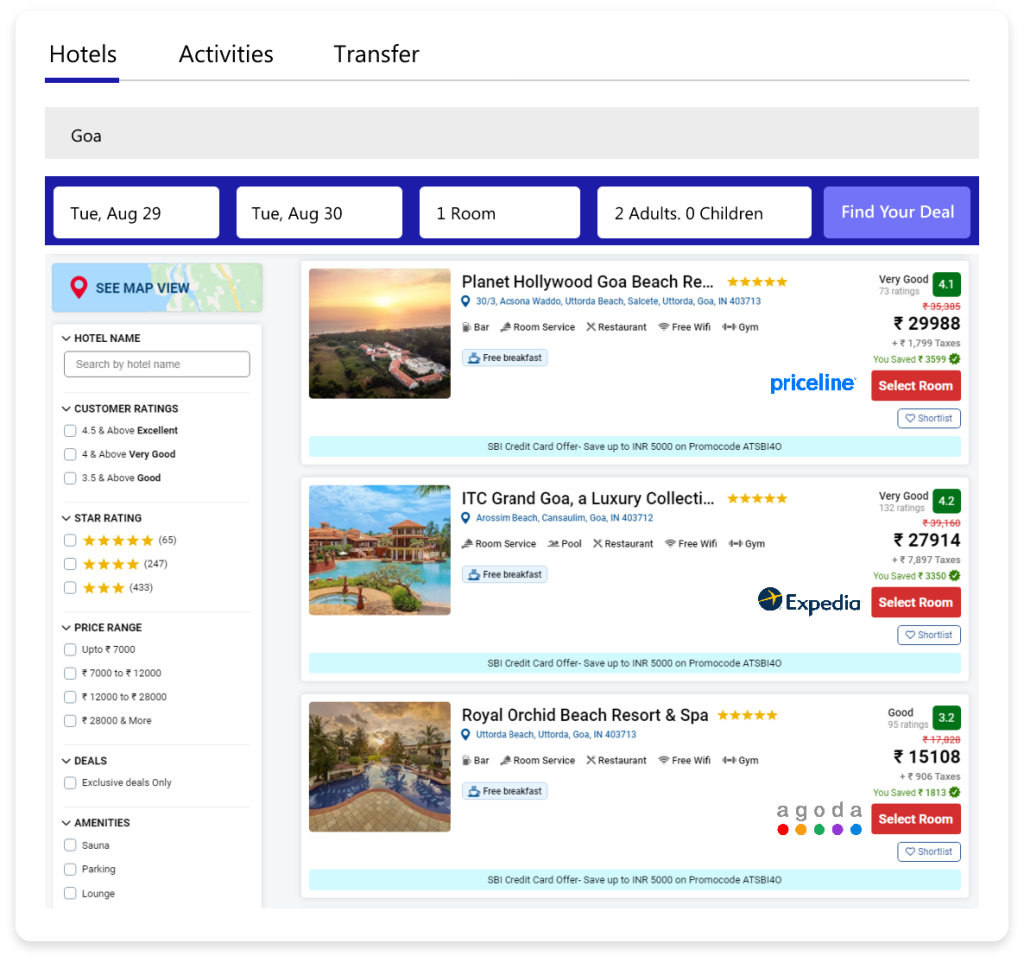

Fastest Hotel Booking Platform for B2B & B2C Customers

B2B – Features

- Ready to integrate 80+ hotel suppliers

- Quick agency and agent onboarding, enabling direct bookings

- Set custom markup, discounts, and commissions

- Integrated hotel, room mapping, & currency mapping

B2C – Features

- Establish your B2C brand in the travel industry

- Supplier management, search patterns, multi-currency support

- White Label solution to make personalized interface

- Multiculture & Currency standardization

- Powerful data insights to take business decisions

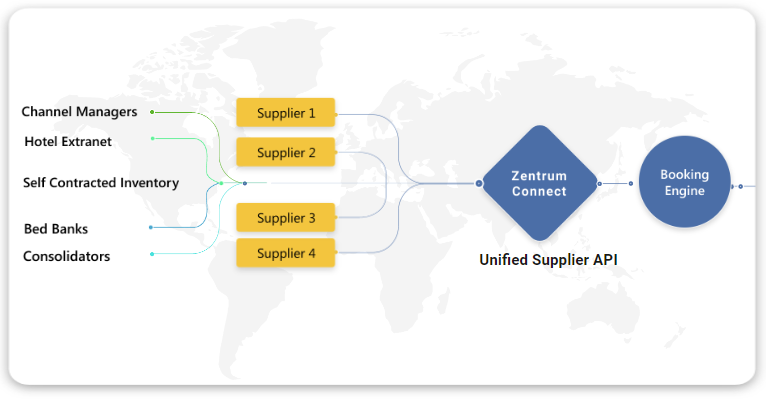

Zentrum Connect

Global Hotel Supplier Connectivity

- Get connected with 80+ suppliers, GDS, bedbanks and channel managers

- Multi point of sales to access public, CUG, corporate and netRates

- Pre-certified and optimized Supplier integration

- Flexible pricing options, including per-connector and usage-based models

-

- Integrated Suppliers

Get to know Pre-Integrated 75+ Hotel Suppliers with ZentrumHub

- ZentrumHub

- Insights

Insights by ZentrumHub

- Case Studies

- Press & Media

- Blog

- Events

- Webinar

- Awards

- Products

Products by ZentrumHub

-

Zentrum Booking Engine

Zentrum Booking Engine

-

Zentrum Connect

Zentrum Connect

Zentrum Booking Engine

Fastest Hotel Booking Platform for B2B & B2C Customers

B2B – Features

- Ready to integrate 80+ hotel suppliers

- Quick agency and agent onboarding, enabling direct bookings

- Set custom markup, discounts, and commissions

- Integrated hotel, room mapping, & currency mapping

B2C – Features

- Establish your B2C brand in the travel industry

- Supplier management, search patterns, multi-currency support

- White Label solution to make personalized interface

- Multiculture & Currency standardization

- Powerful data insights to take business decisions

Zentrum Connect

Global Hotel Supplier Connectivity

- Get connected with 80+ suppliers, GDS, bedbanks and channel managers

- Multi point of sales to access public, CUG, corporate and netRates

- Pre-certified and optimized Supplier integration

- Flexible pricing options, including per-connector and usage-based models

-

- Integrated Suppliers

Get to know Pre-Integrated 75+ Hotel Suppliers with ZentrumHub

- ZentrumHub

- Insights

Insights by ZentrumHub

- Case Studies

- Press & Media

- Blog

- Events

- Webinar

- Awards

Top 10 Hotel Suppliers in 2025: Guide for OTAs

Abhinav Sinha

The online travel industry is experiencing unprecedented growth in 2025, with global OTA market capturing 40% of total travel bookings worldwide. For Online Travel Agencies (OTAs) looking to expand their hotel inventory and maximize revenue, understanding the top hotel suppliers and their API capabilities is crucial for competitive success.

This comprehensive guide examines the top 10 hotel suppliers in 2025, with detailed analysis of their API integration capabilities, inventory scope, and strategic advantages for OTA partners. From industry giants like Expedia API and RateHawk API to specialized providers like WebBeds API and HotelBeds API, we’ll explore how each supplier can enhance your booking platform.

Hotel Suppliers vs. OTAs

Before diving into specific suppliers, it’s essential to understand the distinction between hotel suppliers and OTAs in the travel distribution ecosystem:

Hotel Suppliers provide inventory and content to distribution partners through APIs, acting as wholesalers or bed banks that aggregate hotel rooms from properties worldwide.

OTAs (Online Travel Agencies) are customer-facing platforms that sell hotel inventory to end consumers, utilizing supplier APIs to power their booking engines.

This guide specifically targets OTA decision-makers seeking reliable supplier partnerships to enhance their hotel offerings.

1. Booking.com (Booking Holdings) - Market Domination

Market Position & Scale

Booking.com had the largest market share, dominating with 69.3%, while Expedia Group followed behind with 11.5% in the European hotel market. As of January 2025, Booking Holdings maintains a market capitalization of approximately $154.74 billion.

Inventory & Coverage

- Properties: 4.5+ million accommodations globally

- Geographic Reach: 220+ countries and territories

- Languages: 45 languages supported

- Verified Reviews: 350+ million guest reviews

- Daily Transactions: Processing millions of bookings daily

API Capabilities

While Booking.com primarily operates as an OTA, they offer APIs and SDKs for integration partners, including their In-App Software Development Kit (SDK) for native mobile applications.

Key Features:

- Real-time availability and pricing

- Multi-language content support

- Mobile SDK integration

- Extensive property content and imagery

Strategic Value for OTAs

Booking.com’s massive inventory and brand recognition make it a valuable distribution partner for smaller OTAs seeking premium content and competitive rates.

2. Expedia API (Expedia Group) - Comprehensive Travel Solutions

Market Position & Scale

Online travel agencies (OTAs) like Airbnb, Booking Holdings, Expedia Group, and Trip.com Group collectively increased their marketing spend to $4.5 billion in Q1 2025, demonstrating Expedia’s continued investment in market growth.

EPS Rapid API Overview

EPS Rapid is an intuitive API that offers travel companies with access to competitive rates and a vast portfolio of +600,000 Expedia Group properties. The Expedia API has evolved into one of the most sophisticated hotel booking APIs available to OTAs.

Inventory & Coverage

- Properties: 700,000+ accommodations worldwide

- Property Types: 40+ categories from hotels to houseboats

- Geographic Mapping: 600,000+ intelligent geography mappings

- High-Quality Content: 29+ million property images, 21+ million room images

- Reviews: 58+ million verified reviews, 75+ million traveler ratings

Technical Specifications

API Architecture:

- RESTful API design for modern integration

- Modular architecture for customizable implementation

- Lightweight and scalable infrastructure

- Performance: Handles over 6 billion API calls daily

Key Features:

- Real-time availability and booking

- Dynamic pricing and rate management

- Extensive property content and imagery

- Multi-currency and multi-language support

- Advanced search and filtering capabilities

Integration Benefits for OTAs

With Rapid API, your travelers will have access to 700K properties around the world, from hotels to house boats. And as a Rapid API partner, you can also leverage our detailed property, room, and user-generated content.

Revenue Opportunities:

- Access to exclusive distribution rates

- Commissionable competitive rates

- Package deal opportunities

- Opaque rate programs

Implementation Process

- Partner Application: Contact Expedia Partner Solutions

- Technical Integration: API documentation and sandbox access

- Certification: Testing and validation process

- Go-Live: Production environment access

- Ongoing Support: Dedicated account management

Reference: Expedia Group Rapid API

3. RateHawk API (Emerging Travel Group) - B2B Innovation Leader

Company Overview

RateHawk is an innovative B2B booking platform that offers hotels, flight tickets, transfers, car rentals, and other travel-related services, providing access to over 2.6 million accommodations from more than 100,000 directly contracted properties and over 260 wholesalers.

Inventory & Coverage

- Properties: 2.7+ million hotels and accommodations

- Direct Contracts: 100,000+ properties

- Wholesaler Partnerships: 320+ global suppliers

- Geographic Coverage: 220 countries worldwide

- Languages: 32+ languages supported

RateHawk API Technical Features

RateHawk Travel API and get access to a hotel booking system and best deals worldwide. Gain customized and rapid integration with our clear API documentation and the assistance of our dedicated support team.

Core Capabilities:

- Real-time availability and pricing

- Instant booking confirmations

- Multi-language hotel content

- Competitive B2B rates

- Flexible payment terms

API Integration Advantages

APIs enable them to create their own custom-made products that connect to online booking tools, like RateHawk. Using an API, a company has the ability to tap into an extensive list of suppliers and an inventory of accommodation at great prices.

Key Benefits for OTAs:

- Fast Integration: Quick setup with comprehensive documentation

- Reliable Performance: High-speed responses under load

- Global Support: 54 regional offices with local expertise

- Competitive Rates: Access to wholesale pricing

- Multi-Service Platform: Hotels, flights, transfers, car rentals

Recent Growth & Partnerships

More than 100 tech platforms are now connected to RateHawk via API, providing seamless access to a broad range of travel products and services for professionals worldwide.

2025 Expansion:

- Added 90+ global wholesalers since early 2024

- Signed direct contracts with 44,000+ properties

- Enhanced mobile and platform integrations

Integration Process

- Registration: Quick signup process

- API Access: Immediate access to documentation

- Technical Support: Dedicated integration specialists

- Testing: Sandbox environment for development

- Deployment: Production API keys and go-live support

Reference: RateHawk API Integration

4. HotelBeds API - World's Leading B2B Platform

Market Leadership

Hotelbeds, now operating under the HBX Group umbrella, remains the world’s leading B2B travel solutions provider. The company boasts a portfolio of over 250,000 hotels, serving 71,000 travel distributors across 191 countries.

Inventory & Coverage

- Properties: 300,000+ directly contracted hotels

- Geographic Reach: 191 countries worldwide

- Distribution Partners: 71,000+ travel distributors

- Direct Contracts: 100% of portfolio directly contracted

- Additional Services: Activities, transfers, ground services

APItude Suite Overview

APItude is Hotelbeds’ main API suite, providing a range of functionalities designed to cater to hotel distribution and management needs. The suite comprises three primary APIs for hotels, activities, and transfers.

Core API Components:

- Booking API: Reservation management and booking processes

- Content API: Static and dynamic hotel information

- Transfer API: Ground transportation services

Technical Capabilities

Advanced Features:

- Real-time availability and pricing

- Comprehensive property content

- Multi-destination search capabilities

- Automated booking confirmations

- Extensive geographical coverage

Code Support:

- IATA airport codes

- ATLAS custom hotel codes

- GPS coordinates with address descriptions

Strategic Acquisitions

In 2017, Hotelbeds solidified its market leadership by acquiring GTA and Tourico Holidays, significantly expanding their global inventory and market reach.

Integration Benefits

- Market Leadership: Access to world’s largest bed bank

- Direct Contracts: Premium rates and reliability

- Comprehensive Support: 24/7 technical assistance

- Proven Technology: Battle-tested APIs handling massive volume

Reference: HotelBeds Developer Hub

5. WebBeds API - Fastest Growing B2B Platform

Rapid Market Growth

Established in 2013, WebBeds has rapidly grown into the second-largest and fastest-growing B2B bed bank globally. Its marketplace connects over 50,000 travel buyers in more than 140 source markets with a diverse inventory of 500,000+ hotels and 23,000+ ground services.

Inventory & Coverage

- Properties: 500,000+ hotels worldwide

- Direct Contracts: 90,000+ properties

- Destinations: 14,000+ destinations

- Travel Buyers: 50,000+ connected partners

- Source Markets: 140+ markets

WebBeds API Features

Offer your clients real-time availability, rates, impressive photo galleries and complete descriptions of your travel products with just one API integration with WebBeds. More than 368,000 hotels in 14,000 destinations are ready to be booked by your agents or travelers.

Core Capabilities:

- Real-time inventory management

- Competitive wholesale pricing

- Rich content and imagery

- Multi-language support

- Global ground services integration

Brand Portfolio

WebBeds operates through multiple regional brands:

- JacTravel DMC: UK and European focus

- Sunhotels: Mediterranean specialist

- Destinations of the World (DOTW): Asian market strength

- FIT Ruums: Independent traveler focus

- Lots of Hotels (LOH): Budget accommodation focus

Competitive Advantages

One of the newer bed banks, WebBeds, recently surpassed industry giant HotelBeds in terms of number of partner hotels, which is quite an achievement considering HotelBeds had a decade’s head start.

Key Differentiators:

- Rapid growth and expansion

- Competitive pricing structure

- Strong Asian market presence

- Diverse brand portfolio

- Technology-forward approach

Integration Process

- Partner Application: Direct contact through WebBeds

- Commercial Agreement: Negotiate terms and conditions

- Technical Integration: API documentation and support

- Testing Phase: Sandbox environment validation

- Production Launch: Live API access and monitoring

Reference: WebBeds Global Marketplace

6. Agoda API (Booking Holdings) - Asia-Pacific Specialist

Market Position

Agoda moved up 1 spot this year in industry rankings, demonstrating continued growth in the competitive OTA market.

Inventory & Coverage

- Properties: 2+ million listings worldwide

- Languages: 38 languages supported

- Market Focus: Strong Asia-Pacific presence expanding globally

- Commission Structure: ~16% average commission rates

- Parent Company: Booking Holdings portfolio

API Capabilities

Core Features:

- Asia-Pacific inventory specialization

- Competitive pricing algorithms

- Multi-language content support

- Mobile-optimized booking flows

- Local market expertise

Strategic Value

- Regional Expertise: Deep Asia-Pacific market knowledge

- Booking Holdings Network: Access to cross-platform inventory

- Growing Global Presence: Expansion beyond Asian markets

- Competitive Rates: Strong negotiating power with suppliers

7. Trip.com Group API - Chinese Market Leader

Market Expansion

Trip.com Group is formulating a new strategy for penetrating the European market as a long-haul travel niche leader and eventually going global.

Investment & Growth

Trip.com Group, although still trailing behind other major OTAs in terms of total spend, increased its marketing investment by 30% to $413 million in Q1 2025.

Technology Innovation

AI Integration:

- TripGenie AI travel assistant

- Advanced recommendation engines

- Personalized booking experiences

- Machine learning pricing optimization

Market Position

- Primary Market: Asia-Pacific dominance

- Global Strategy: European market penetration

- Technology Focus: AI-powered travel solutions

- Growth Rate: 30% marketing investment increase

8. Airbnb API - Alternative Accommodation Leader

Market Scale

As of 2024, Airbnb’s market value is approximately $74 billion, and it commands over 20% of the vacation rental industry.

Strategic Evolution

Business Expansion: Airbnb also increased its marketing spend by 9.5% to $563 million, focusing on expanding beyond its traditional accommodation offerings.

API Capabilities

- Alternative accommodation focus

- Experience marketplace integration

- Host management tools

- Property listing optimization

Note: As of this writing, Airbnb isn’t accepting new API access requests and is struggling with the pandemic consequences that heavily hit both Airbnb and its hosts.

9. Hotels.com API (Expedia Group) - Dedicated Hotel Platform

Platform Specialization

Hotels.com operates as Expedia Group’s dedicated hotel booking platform, focusing specifically on accommodation bookings rather than full-service travel.

Key Features

- Hotel-only booking specialization

- Hotels.com Rewards loyalty program

- Repeat customer focus

- Global hotel inventory access

Integration Benefits

- Simplified Implementation: Hotel-focused API

- Loyalty Integration: Built-in rewards program

- Expedia Network: Access to broader inventory

- Specialized Support: Hotel booking expertise

10. Trivago API (Expedia Group) - Metasearch Power

Metasearch Leadership

Trivago operates as one of the world’s leading hotel metasearch engines, providing price comparison and hotel discovery services.

Business Model

- Pay-per-click advertising: Revenue through referral clicks

- Price comparison: Multi-supplier rate comparison

- Global reach: Worldwide hotel search coverage

- Integration network: Multiple OTA and supplier connections

Strategic Value

- Market Visibility: Brand exposure through metasearch

- Customer Acquisition: Lead generation capabilities

- Price Intelligence: Market rate monitoring

- Global Reach: International market access

API Integration Strategies for OTAs

Multi-Supplier Approach

A viable scenario would be integrating with one or multiple channel managers and also with some wholesalers to get broad hotel coverage.

Recommended Strategy:

- Primary Suppliers: 2-3 major suppliers for core inventory

- Regional Specialists: Geographic-specific suppliers

- Niche Providers: Specialty accommodation types

- Backup Sources: Redundancy for high-demand periods

Technical Considerations

Integration Complexity:

- RESTful APIs: Modern standard for new integrations

- Response Times: Sub-second performance requirements

- Data Mapping: Standardized content normalization

- Error Handling: Robust failure management

Content Management: But the biggest concern for you is that some channel managers don’t provide content. They’ll support you with availability and rates, but images and description are on you.

Performance Optimization

Key Metrics:

- Response Time: < 2 seconds for search results

- Availability Accuracy: > 98% real-time accuracy

- Booking Success Rate: > 95% confirmation rate

- Uptime Requirements: 99.9% API availability

Market Trends & Future Outlook

The luxury tourism market will grow significantly, expected to reach $1.2 trillion by 2026, driven by Gen X and Millennials seeking exclusive, tailored experiences.

Technology Evolution

AI Integration:

- Personalized recommendation engines

- Dynamic pricing optimization

- Automated customer service

- Predictive analytics for demand forecasting

Mobile-First Approach:

- Responsive API design

- Mobile SDK availability

- App-specific optimizations

- Voice booking capabilities

Sustainability Focus

76% of travelers said they want to travel more sustainably during the year ahead, driving demand for eco-friendly accommodation options.

ZentrumHub: Unified Hotel Supplier Access

Simplified Integration Solution

While integrating with multiple hotel suppliers individually can be complex and time-consuming, ZentrumHub offers a streamlined alternative for OTAs seeking comprehensive hotel inventory access.

Pre-Integrated Supplier Network

ZentrumHub has already completed integrations with 100+ hotel suppliers, including the major suppliers featured in this guide:

- Expedia API – EPS Rapid complete integration

- RateHawk API – Full inventory access

- WebBeds API – Complete marketplace access

- Agoda API – Asia-Pacific specialist inventory

- Priceline API – Express deals and discounted rates

- TBO API – B2B travel distribution platform

- HotelBeds API – APItude suite connectivity

- Yatra API – Indian market specialist

- Additional Suppliers: 92+ other verified partners

Benefits for OTAs

Single Integration, Multiple Suppliers:

- One API connection for 100+ suppliers

- Standardized data formats across all sources

- Unified content management

- Consolidated booking management

Reduced Technical Complexity:

- Pre-built supplier connections

- Standardized error handling

- Common authentication system

- Unified documentation

Faster Time-to-Market:

- 30-day implementation vs. 6+ months for individual integrations

- Pre-negotiated commercial terms

- Proven reliability and performance

- Dedicated technical support

Commercial Advantages

- Competitive Rates: Leveraged buying power

- Flexible Terms: Customizable commercial structures

- Risk Mitigation: Diversified supplier portfolio

Scalability: Easy addition of new suppliers

Conclusion: Strategic Supplier Selection

The hotel supplier landscape in 2025 offers unprecedented opportunities for OTAs to access global inventory and enhance their competitive position. Success depends on strategic supplier selection, effective API integration, and ongoing optimization of the booking experience.

Key Takeaways for OTAs:

- Diversification is Critical: Multi-supplier strategies reduce risk and increase inventory breadth

- API Quality Matters: Focus on reliable, fast-performing integrations

- Content Richness: Prioritize suppliers offering comprehensive property information

- Regional Expertise: Include geographic specialists for key markets

- Technology Forward: Choose suppliers investing in AI and mobile optimization

Strategic Recommendations:

For New OTAs:

- Start with 2-3 major suppliers for foundation inventory

- Consider aggregated solutions like ZentrumHub for rapid deployment

- Focus on core markets before expanding globally

For Established OTAs:

- Optimize existing supplier relationships

- Explore niche suppliers for competitive differentiation

- Invest in advanced integration technologies

For Global OTAs:

- Maintain comprehensive supplier portfolio

- Leverage regional specialists for local market expertise

- Implement advanced technology for personalization

The hotel supplier ecosystem continues evolving rapidly, driven by technology innovation, changing traveler expectations, and market consolidation. OTAs that strategically leverage the best supplier partnerships while maintaining operational efficiency will be positioned for sustainable growth in the competitive travel market.

Recommended Blogs

- Hotel Suppliers vs. OTAs

- 1. Booking.com (Booking Holdings) - Market Domination

- 2. Expedia API (Expedia Group) - Comprehensive Travel Solutions

- 3. RateHawk API (Emerging Travel Group) - B2B Innovation Leader

- 4. HotelBeds API - World's Leading B2B Platform

- 5. WebBeds API - Fastest Growing B2B Platform

- 6. Agoda API (Booking Holdings) - Asia-Pacific Specialist

- 7. Trip.com Group API - Chinese Market Leader

- 8. Airbnb API - Alternative Accommodation Leader

- 9. Hotels.com API (Expedia Group) - Dedicated Hotel Platform

- 10. Trivago API (Expedia Group) - Metasearch Power

- API Integration Strategies for OTAs

- Market Trends & Future Outlook

- ZentrumHub: Unified Hotel Supplier Access

- Conclusion: Strategic Supplier Selection

- Recommended Blogs