FAQ's: How to Choose Payment Gateways for OTAs?

Security supported payment methods, global reach, transaction fees, and ease of integration are all crucial factors. You should also consider customer support options.

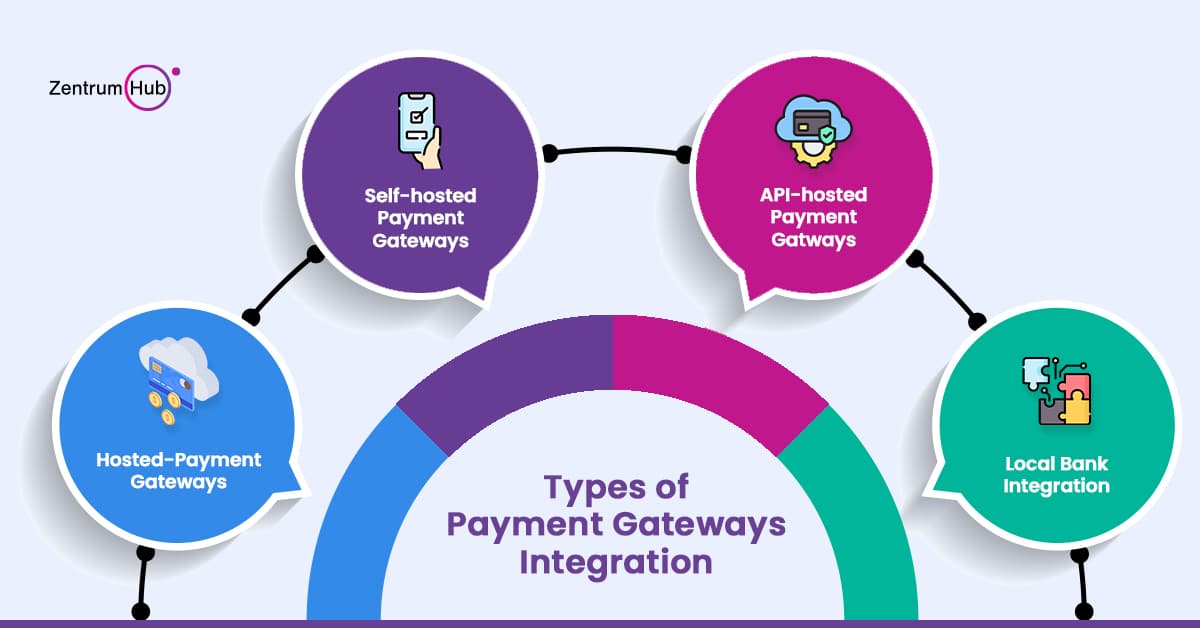

There are four main methods: hosted, self-hosted, API-hosted, and local bank integration. Hosted gateways are the easiest to set up but offer less customization. Self-hosted offer more control but require technical expertise. API-hosted provide a balance between flexibility and security. Local bank integration can be beneficial for specific markets but may have additional complexities.

An MOR assumes responsibility for PCI DSS compliance and financial transactions for an OTA. This can be a good option for OTAs that lack the technical expertise or resources to manage PCI compliance themselves. However, it also means giving up some control over the customer payment experience and potentially paying additional fees.

Yes, ZentrumHub offers Stripe and Authorize.net for international customers. For Indian customers, they use Nimbbl, which aggregates multiple payment gateway providers. They are also open to integrating new options based on client needs.